TP5 Podcast: Isomer Capital — SpaceX, Nvidia & Revolut Insights

Backing Europe's VC champions early & doubling down on their breakout companies.

We're 100% dedicated to ALL of Europe

Not just London and Berlin

4160

Funds Screened

1664

VC Firms Tracked

93

VC Fund Investments

2249

Underlying Portfolio Companies

29

Direct Co-investments

44

Portfolio Unicorns

Moments of truth

We work with super smart people that are not needy. But there are moments of truth where they need a partner. A friend. A helper. And if we can be there at that moment, we've done our job.

Joe Schorge

Managing Partner

The latest insights

The TP5 team sits down with Joe Schorge and Omolade Idebisi of European fund of…

Unlocking European Tech – Hosted by Nodem Capital

Isomer’s Michael Joyce recently joined a panel discussion on European Secondaries as part of the…

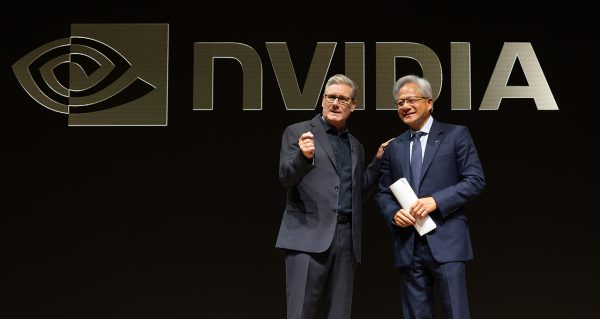

NVIDIA calls out 5 Isomer underlying portfolio as part of their pledge to invest £2bn in UK AI startups

Read the full article here Back in February, Sifted reported on NVIDIA’s 11 European Investments.…